The majority of auctioneers were already set up for online bidding, most through the Invaluable platform. However the high fees of Invaluable of 5% on top of the hammer price meant that expensive artworks would face the biggest challenges, plus they could not be viewed in person.

But collectors have adapted surprisingly well to the changed conditions with auction houses upping the phone bidding numbers (a trend going on for several years already), and offering buyer’s parity to offset the Invaluable fees.

Now, as Deutscher + Hackett have proven with their sales in lock-down Melbourne, you do not need those bidders in the room at all. In the international arena, Sotheby’s and Christies went one step further by setting up live TV studios and simultaneous bidding from these studios in their major hubs in New York, London, Paris and Hong Kong.

The high level of confidence in the Australian art market may have been driven to some extent by a more uncertain share market and also by collectors spending a lot of time at home, as they were not able to holiday overseas. Art as therapy seems to have worked.

Once all the auction results for 2020 are tallied up by AASD, a total turnover of $107 million looks likely; it currently sits at $105,932,000. In 2019, total fine art auction results were just above $111 million.

An interesting new addition to auction sales this year has been the single artwork auction. This format has clearly caught the imagination of auction houses and collectors alike, but, as principal Damian Hackett said to us “It has to be the right picture”. They proved it on June 3rd, selling Del Kathryn Barton’s portrait of Hugo Weaving (and winner of the 2013 Archibald Prize) for $220,000 (est. $120,000-160,000).

In October, Smith & Singer sold Brett Whiteley’s The Arrival – A Glimpse in the Botanical Gardens, 1984, owned by long-time art dealer Denis Savill for $1.325 million (est. $900,000-1.2 million).

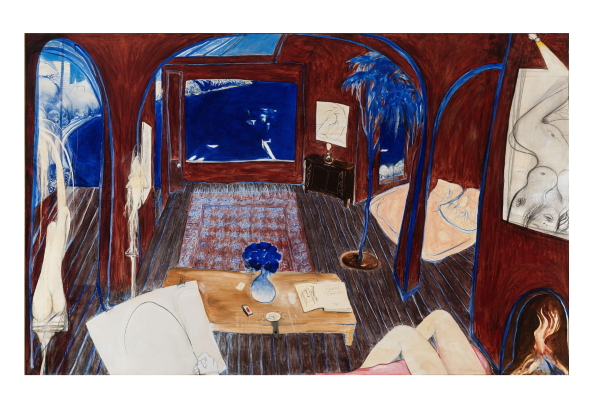

Menzies capped off the year with a new all-time Australian art auction record in this new format, selling Brett Whiteley’s Henri’s Armchair, for $5 million hp (6.136 million IBP), beating the artist’s record for My Armchair, of $ 3.2 million, also sold by Menzies in 2013.

Not only did 2020 see the highest price for an Australian painting sold at auction, there were a important number of individual artist’s records set. Deutscher + Hackett achieved a very impressive $2.822 million IPB for Fred Williams’ Hummock in Landscape, 1967, eclipsing You Yangs Landscape 1, 1963, sold for $2.287 million by Bonhams in 2013.

In the same auction in July, they also achieved a record price for a work by Hans Heysen: A Summer’s Day, c1907, sold for $601,364 IBP, overtaking Bonhams’ sale in 2019 of The Farmyard, Frosty Morning, 1926 (sold for $341,600 IBP).

For colonial artist George French Angas, it was a much longer time between records: Going back to May 2003, Christies sold Twelve Studies for $293,750 IBP. Now just at the end of November, Bonhams achieved $418,200 IBP for Eaglehawk Gully, Bendigo, 1851, an early evocative image of the goldfields that went viral (at the time) in the form of a lithograph.

Smith & Singer achieved the highest ever price for a work by ever popular Elioth Gruner with the sale of A Land of Wide Horizons, Michelago, 1922, which sold for $386,591 IBP in their September sale, beating On the Sands, 1920 (sold at Menzies in April 2018 for $270,000 IBP).

The most unexpected record price was for a horse race painting by Robert Dickerson: Early Morning, Randwick, 1994, sold at Menzies for $282,273 IBP (est. $50,000-70,000) in November, surpassing Sotheby’s previous record of $183,000 IBP for a much earlier painting from 1954, The Bottle.

Important new highs were also achieved on the contemporary side, with Ben Quilty’s Paul’s Falcon, 2008, selling for $171,818 IBP at Deutscher + Hackett (previous high One Big One, $97,600 IBP, also with D+H in ).

Likewise for Aboriginal art, a set of 12 photographs by Michael Cook titled Civilised from 2012, sold for $108,000 with Deutscher + Hackett (previous high $85,400 in June 2018 also with D+H).

Significant records were set for three female artists: Yvonne Audette’s Cantata No. 14, 1963-64, with its strong and seductive colour palette achieved $294,545 at Deutscher + Hackett, or almost three times her previous record of $103,700 from 2018 for another Cantata (No. 16) set by Sotheby’s, setting a significant benchmark for one of Australia’s most important abstract painters.

Iso Rae’s 2017 record price of $109,800 for Les Acheteuses (The Buyers), c1913, was also almost tripled by Deutscher + Hackett, when they offered Young Girl, Etaples, c1892 in July this year. It settled on a new record price of $270,000.

Alison Rehfisch’s art has also benefitted from the focus on female artists: her long standing highest price from April 1989 of $26,000 for Harbour Scene with Fishing Boats at Leonard Joel only just got truly thrashed with the sale of Cagnes, c1937, for $103,700, wildly surpassing its estimates of $2,000-4,000 at Bonhams in October.

The top sales of the year comprise the artists we would expect, among them Brett Whiteley (in top spot and with an all-time Australian auction record), Russell Drysdale, Fred Williams and Jeffrey Smart.

The second place in 2020 goes to Russell Drysdale’s Going to the Pictures, 1941, which achieved $2.945 million at Deutscher + Hackett in November. D+H also set third and fourth spots with not one, but two paintings by the late and great Fred Williams, the aforementioned Hummock in Landscape in third and the fourth Hillside at Lysterfield II 1967, selling for $$2.209 million in November.

You can access all top 10 auction prices for 2020 here: https://www.aasd.com.au/index.cfm/top-10-sale-prices/

There were some very encouraging signs for the Aboriginal art market in 2020 outside Australia, with the exhibition of American comedian Steve Martin’s collection with mega-dealer Larry Gagosian in New York in collaboration with Melbourne art dealer D’Lan Davidson. And just last week news broke that Davidson brokered the sale of a major Aboriginal art collection owned by a North American collector to a Swiss connoisseur for several million dollars.

This international news has complemented the overall auction sales of Aboriginal art in Australia: this year, they have doubled compared to 2018 and 2019, from $6.69 million and $6.19 million respectively to $12.35 million – and this excludes all sales of Aboriginal art outside Australia. For example, Sotheby’s online sale in New York just last week generated US$1.035 million (about AU$1.393 million), a collaboration with Australian art dealer and consultant Tim Klingender.

Traditionally low clearance rates for Aboriginal art have started to improve, as more collectors are attracted back into this market. Deutscher + Hackett took advantage of these more favourable conditions just prior to Covid disruptions, with a very successful stand-alone Aboriginal art sale in mid-March, achieving $2.36 million IBP, and have continued with a number of online only sales of Aboriginal art.

Adrian Newstead continued his own Aboriginal art auction sales under the branding of Coo-ee Art Market Place. Newstead and his business partner’s Mirri Leven’s second 2020 sale in October was particularly successful, realising $1.836 million IBP.

Most of the votes (auction sales results recorded) are now counted, and sit at just under $106 million, with up to one million dollars to add. By auction house, Deutscher + Hackett are in first place with $26.28 million of sales, followed by Menzies with $22.6 million, Smith & Singer with $21.58 million, Bonhams with $7.67 million, Leonard Joel with $7.13 million, and $20.665 million for all other auction houses who submit results to AASD.