The sale immediately kicked into gear with a quick uptake of lots, albeit often below low estimate but within competitive circumstances.

Lot 22, Clarice Beckett’s Evening Calm marked the start of the Barbara Heine Estate and it provided the first dose of palatable auction tension; bids bounced back and forth between the phones to $44,000 hammer, a result beyond listed expectations.

Sidney Nolan’s Man in Horse Drawn Cart… (Lot 23 ) followed suit selling almost 20% higher than its estimate at $41,000. In fact, all 8 lots found happy new homes and delivered a great result of 1.398 million for the Kids and Families Foundation.

This is in spite of about half the lots selling well below low estimate including the two works by Tim Maguire; Untitled was a bargain at $50,000 against a $70,000 low estimate.

The standout result for the collection was $1.15 million for Brett Whiteley’s head-turner, Little Orange (Sunset) (Lot 27 ). The room bidder added some welcome theatre calling out “leapfrog” bids in an attempt to unbalance his telephonic rival.

Ultimately the rival won out and the sun set at a price 35% higher than its upper estimate. This result placed the work within Whiteley’s top ten results and consolidated his place as the second most traded artist in 2010, pipped only by Sidney Nolan.

Six out of Menzies ten prime lots sold, including Pierre Bonnard’s Bouquet de chemineé (Lot 35 ). In 2008, the still life was hammered at $1.1 million, so presumably its new buyer was very satisfied to secure it at mid-estimate for $975,000.

Expectations of a strong result for the relatively fresh (at least by 21st century standards) Dampier III by Jeffrey Smart were slightly dashed, when it was knocked down at $260,000, short of its $280,000 low estimate (Lot 34 ).

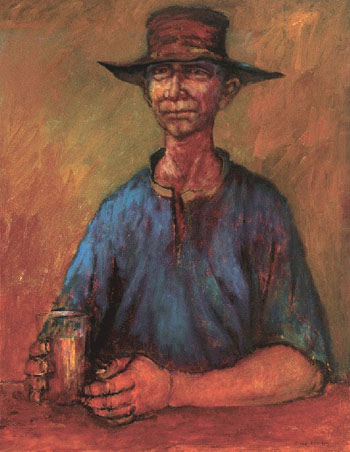

Two lots later when Warrego Jim (Lot 36 ) was put on the block, the mood shifted; the room was transfixed witnessing a vigorous three-way contest, something that has become a rarity in the higher echeleons of the market.

The auctioneer confidently launched Russell Drysdale’s work at $800,000 low estimate and from there it crept up in $25,000 increments, (spicing up the drama quotient) to $1.05 million, sold to an unidentified phone bidder.

The fate of the Drysdale attests to the conservative attitude of the market where discerning collectors are setting the tone, acquiring classic artists that are tried and true and are paying astute and considered prices…or are willing to compete, if need be, for the especially rare or outstanding.

A distinct lack of interest greeted the big ticket lot of the auction, John Brack’s Double Nude (Lot 37 ) and it failed to sell, thereby putting a significant dent of almost 20% in the sales takings.

Issues of overexposure, related not to Brack’s subjects, rather its repeated re-marketing (four catalogue appearances in about a decade), took centre stage and meant collectors shied away from its “exhibitionist” history!

The pace of the sale noticeably deaccelerated and hit some speed humps in the wake of the top lots. As the audience became picky and unenthused over lacklustre lots or the typical auction fodder, flickers of frustration afflicted auctioneer Martin Farrah; whacking his gavel against the podium and expressions such as “wakey, wakey..[it’s a] Shoalhaven (Lot 46 )” and “I can’t quite believe it” as another lot passed in.

Across all estimate brackets, pre-sale expectations were reduced. However the weakest areas were in the $20-50k and $50-100k ranges which only achieved 50% of their targets, as well as $100-200k which recorded only a 25% success rate with 3 of the 4 lots in this range failing to sell.

The patchy performance of the middle ranking lots would probably have been worse if the auction house had not ensured that reserves were consistently well below their estimate.

Overall the sale achieved results of 63% by value and 70.5% by volume amounting to a result of $6.268,500 IBP. A quick view of where the hammer fell in relation to catalogue estimates reveals that a resounding 53.5% sold at or below estimate, suggesting that Menzies had also factored in the pre-Christmas sentiment; a further 10% sold within their range and 7% exceeded high estimate.

Strongly represented in the 29.5% of lots unsold were a slew of auction stalwarts that were decidedly off the boil; including David Boyd, Gary Shead, Robert Dickerson and Charles Blackman.

The latter found himself not doubly, but thrice unlucky, with Double Nude, Three Figures and Schoolgirls (amnother trio) all passing-in. The bad press relating to the Blackman and Dickerson could also have affected confidence in their markets.

Collectors also tuned out from Tracey Moffatt’s series, Something More no 2. Not a skerrick of interest was sparked, despite a modest estimate, illustrating a stark reversal of fortune for the artist whose market a decade ago was on a rapid climb.

Displaying more sizzle than fizzle was Aida Tomescu’s Albastru IV (Lot 17 ). Four bidders pursued it to $18,000, just short of its estimate, but achieving her highest price since 2005 and equalling her third highest auction record - promising signs for Tomescu’s secondary market future.

An artist who has already consolidated her presence in the secondary market is Bronwyn Oliver. Without much fanfare, a commission bidder took Oliver’s Shell to low estimate of $200,000 setting the artist’s second highest auction price and ensuring Oliver’s status as the 9th most traded artist in 2010.

Rod Menzies acknowledged that there is an inherent danger scheduling an auction a week or so shy of Christmas. However this auction bucked expectations and overcame many of the usual end –of-year hurdles producing better than anticipated results.

The auction house would have been particularly encouraged by the increased level of competition experienced by Whiteley and Drysdale works when compared with the response to these artists in their September round.

They would also be very satisfied that their final auction for 2010 has yet again beaten the sales total of its rivals, sealing their domination of every round. In spite of these chest thumping statistics, for the writer it was really the dymamic of the sale and the performance of the upper end that gives cause for optimisim in 2011.

Note: all results are quoted as hammer prices.