In terms of volume 42.5% of recorded sales were drawn from works under $20,000, the middle range was weak with 11.5% for lots $20,000-100,000 and the vulnerability of the auction was exposed by lots at $100,000+ accounting for only 2.5% of the sale. Further statistics revealed that over a third of total lots were sold at or below low estimate, only 9.5% sold at mid estimate and critically a further 9.5% at or above high estimate thereby damaging D+H’s chances for success.

Fred Williams did his best to shoulder the auction and 75% of his works sold throughout the course of the auction; Yellow Gorse, Yan Yean (Lot 10 ) enjoyed a short duel before it was hammered a touch below estimate at $170,000. It was most surprising given the quality and beauty of the front cover lot, Pond Lysterfield (Lot 9 ) that it didn’t elicit a bid and was passed in at $200,000. Nevertheless determined salesmanship by D+H ensured that within 24 hours the painting had found a buyer at $220,000.

Williams’ teammate, John Brack set the highest price for the night with Three Women (Lot 7 ) fetching $340,000. Another Brack work, Portrait of Fred Williams (Lot 34 ), was one of the few lots to be contested beyond its upper estimate, eventually selling for $55,000. However Brack left a burning hole in the auction when Portrait of Tam Purves (Lot 8 ) failed to smoke out any buyers and Triumphal March (Lot 4 ) proved the contrary.

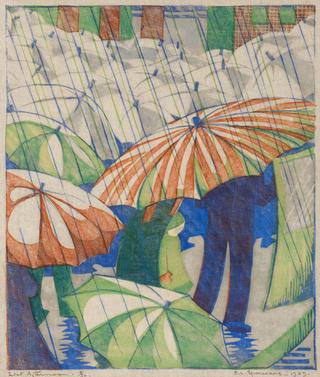

On a brighter note, Ethel Spowers was the belle of the ball; bidding on all fronts saw Wet Afternoon (Lot 1 ) reach $65,000 and come within a whisker of equalling her all time artist record. Swings (Lot 2 ) soared far beyond its upper estimate to fetch $26,000, almost a $10,000 increase upon it’s previous result set four years ago

Godfrey Miller’s masterful painting Summer (Lot 3 ) was justifiably bid to $150,000, more than doubling its low estimate and achieving the second highest price for the artist in over a decade.

Hot competion ensued for Donald Friend’s watercolour, Hill End (Lot 64 ) until a room bidder snaffled it from the telephone for 20,000, almost doubling upper estimate. A similar battle took place for the more obscure work, Fowler Pottery, Camperdown 1895 by John Rider Roberts (Lot 69 ) and it leapt above its quote reaching $32,000.

Respectable results were achieved for William Robinson’s Farmyard Construction with Self-Portrait (Lot 18 ) hammered at its low estimate of $60,000 an increase of $5,000 upon its 2006 Sotheby’s result set in better times.

Tim Maguire’s Untitled ‘fruit’ painting (Lot 26 ) bucked the artist’s pass-in trend and was hammered at $65,000, just shy of its printed estimate.

Disappointments abounded across the entire catalogue and they did not discriminate necessarily on period or price. All of the major moderns suffered the indignity of failing to attract interest including Jeffrey Smart (Lot 5 ), Sidney Nolan (Lot 13 ), Brett Whiteley (Lot 19 ) , John Olsen (Lot 21 ), Arthur Boyd (lots 11 and 14 – this sold later for $90,000) and more recent collector favourites such as Del Kathryn Barton (Lot 23 ) and Garry Shead (Lot 32 ) The poignant, yet overpriced Fredrick McCubbin portraits of his daughters (Lot 27 ) were also ignored.

The contemporary photographic section was priced inexpensively but the majority failed to raise a bid. Perhaps lack of confidence or even disinterest was the culprit.

Collectors were unwilling to quadruple, let alone set records for Charles Henry Theodore Costantini, ‘Rosy Vanyan’, Forcett.Property of Mr Jas Rollings 1855 (Lot 28 ) and bypassed it completely. Happily, successful post-sale negotiation led to another early work, William Buelow Gould’s Still Life with Flowers and Fruit (Lot 29 ) going to a collector for $11,000 lower than its quote for $34,000.

A few bargains existed, especially John Coburn’s Island in the Sun (Lot 17 ) which a room bidder picked up for 30% below estimate at $20,000. Crimson Autograph (Lot 123 ) by Deborah Paauwe, one of the artist’s strongest images might prove to be an insightful and inexpensive buy at $2,000.

A noticeable feature of D+H’s sale was to announce the sale of passed-in lots a few minutes after they had been on the block. Furthermore, auction attendees checking results on D+H’s website would have found that at least 8 more lots exchanged hands than those recorded in their catalogue notes from Wednesday evening which naturally elevated the statistics to a more palatable 62% by volume and 54% by value, quite different to the results cited in the opening paragraph. All of which prompts the question “when does an auction end?” A potent inquiry in straightened times when every lot counts and great import is ascribed to sale rate percentages, let alone the bottom line.

Some argue that because their buyer’s premium applies for up to a week after auction night, all sales can be counted as auction results until posted officially. Others adhere to results achieved during the course of the actual auction when bidding occurs in a combatative atmosphere and on the open market. It could be argued that post-auction results verge towards the private treaty model where the buyer has an exclusive ability to negotiate. Ultimately the recording of post-auction sales hinges on each house’s definition of ‘auction-end’ and there are obviously a range of views on the subject .

D+H were not alone in experiencing a tough sale. They shared good company with Bonhams who have listed results on AASD of 57% by value and 56% by volume and Sotheby’s at 58% and 53% respectively. It’s a big drop since the August sales which generally achieved percentages in the mid to high 70’s. Only the one-off single vendor sales, namely the Anne Lewis collection at Mossgreen and David Bromley at Leonard Joel have reversed this downward trend in the last quarter of 2011 and they operate under different parameters.

Fears surrounding the world economy, particularly Europe, have undoubtedly played a part and there is an overwhelming view that next year might be even more alarming and troublesome. Closer to home many sectors of the Australian economy are soft and parallel markets like real estate are still struggling with clearance rates to climb beyond 55%. So while there is some activity in the art marketplace, perceptions are everything and at the moment most collectors are sitting on the edge of the dance hall bench, watching and waiting…