On the back on an extremely buoyant property market exactly ten years ago, 2007 had produced by far that biggest turnover of art at auction, with a legendary $175 million dollars in sales.

If you are feeling a little deja-vu with, in particular, record property sales in Sydney and Melbourne, one has to ask: is this confidence finally reflected in the art market considering some of the incredible results achieved at Sotheby’s?

The first sale of the night, The David Newby Collection (lots 1 to 30) essentially set the tone for the whole auction, with the most extraordinary paintings selling for truly extraordinary prices, often going for twice the top estimates or even more.

Fisherman, Coogee Beach, 1913 (Lot 1 ) was the first lot from the well publicised and highly regarded collection. This minute painting at 19 x 28 cm was purchased by Mr Newby in November 2006 also at Sothebys for a $65,000 hammer; yesterday, it quickly moved to a hammer price of $135,000, more than twice the previous price and a long way above its $60,000-80,000 estimates.

Interestingly, the record price for a painting by Gruner was set in the boom year of 2007, when “Mingoola Valley”, a much larger painting 59 x 74.5 cm, sold for $125,000 hammer and $164,700 incl. buyer’s premium.

A new benchmark has also been set for Ray Crooke who passed away in 2015. His Thursday Island, 1958 (Lot 4 ) well and truly trounced Thursday Island, 1964, sold by Mossgreen in March 2011 for $95,000 hammer. The new auction record for Crooke is now set at $140,000 hammer and $170,800 IBP, with some extremely spirited bidding both from the phone and the room.

This was mostly the case for most of the evening and not restricted just to the 30 lots in the David Newby catalogue, but for the entire sale of 109 offerings.

After it had sold in boom times to Newby in 2006 for $80,000 hammer, Justin O’Brien’s Palm Sunday (1962) (Lot 2 ) estimated at a modest $60,000-90,000, this ornate painting featuring O’Brien’s beautiful composition of colour, gold leaf and fantasy proved an irresistible temptation for the nine (!) phone bidders. It now sits at the third highest price ever recorded for one of O’Brien’s paintings at $150,000 hammer, almost twice the price paid by Mr Newby.

It wasn’t however all up in the clouds prices paid, and last night also demonstrated the vagaries of changing tastes in art. David Newby appears to have spread his risk well overall. He had purchased Sali Herman’s Woolloomooloo – The Vacant Lot (Lot 3 ) in August 1999 at Sotheby’s for $48,000 hammer and last night, sold for $50,000 hammer – no great loss, but no great gain either, making it part of the “swings and roundabout” territory of changing art tastes.

Meanwhile Arthur Streeton enjoyed his time in the sun last evening: The Path to Podge Newton’s, 1895 (Lot 6 ) had sold admittedly some time ago in 2001 for $74,000 hammer, experienced a considerable upward swing to sell for a very respectable $240,000 hammer, well above expectations of $140,000-180,000.

And yes, not everything sold: Emanuel Phillips Fox’ Market Place, Etaples, 1890 (Lot 7 ) failed to find a buyer at $60,000-80,000, whilst his good friend Frederick McCubbin’s Cottage at Mount Macedon (Lot 8 ) found favour with bidders clamouring to buy one of his idyllic pictures from 1913. The $180,000-220,000 estimates ignored meant a hammer price of $280,000 for this signature work.

John Russell’s very bright Portofino, 1920 (Lot 9 ) also did not disappoint, selling for a $220,000 hammer, $20,000 over its high estimate.

The cover lot of the Newby sale, Arthur Boyd’s Landscape with Waterhole and Herons, near Alice Springs, 1954 (Lot 11 ), had enough spring in its step to sell mid-range at $480,000 hammer, after last selling to David Newby in 1998 for $150,000 hammer – a good return - I think so.

And proving his enduring favour with collectors, 7 of the 9 Arthur Boyd paintings found buyers on the night.

There was a beautiful selection of very high quality Jeffrey Smarts on offer, high quality, but not necessarily large examples, so keeping their prices down to some degree.

Though Study for Holiday (1969-1970) (Lot 12 ) was also a study in how much the market still loves Smart’s work, and perhaps the quirkier the better. This picture with a bald middle aged bloke on a hotel balcony clearly enthused the masses with $200,000-250,000 looking like Sotheby’s had mislaid a hundred thousand dollars from the estimates when it sold for $370,000 hammer.

Our final descent into La-La-Land, or so I thought, was when Albert Tucker’s rather archetypal Explorer, 1964 (Lot 13 ) also sold for $370,000 hammer. This very tightly controlled, though modestly sized painting at 81.4 x 61 cm, had estimates of $150,000-200,000, so I thought anything could happen now.

Well yes, one lucky buyer bought Untitled (Lot 27 ), a lovely side table for a $42,000 hammer, estimated at $15,000-20,000 - but better be careful not to pop your glass of pinot noir too hard on this 1950 John Perceval creation of hand painted earthenware tiles and the best example of this kind of work in some time.

Sotheby’s chief auctioneer Martin Gallon breezed straight on to the mixed vendor catalogue of the sale, (lots 31 to 108) perhaps not wanting to lose any wind out of his sales as what had already proved a very successful result for both David Newby’s skills as a collector coupled with Sotheby’s abilities to sell it for him.

John Brack’s After the Race, 1956 (Lot 31 ) was effectively a second lot 1, as we were at the beginning of another hardbound catalogue. This quintessential 1950s Brack on paper indeed caused a race to buy it, and the pursuit did not stop until a $135,000 hammer was achieved on expectations of $60,000-80,000 – replicating the lot 1’s success.

Ian Fairweather’s highly regarded China Town (1962) (Lot 32 ) also fared very well, selling at $310,000 hammer on $220,000-280,000 estimates.

All but one of the five Jeffrey Smart paintings sold, including Airport at Night, 1969 (Lot 33 ), one of three airline-themed works, selling just above the low estimates for a change at $190,000 hammer.

Considerable interest ensued for a trademark modern assemblage by Rosalie Gascoigne, the large Summer Fat 1995 (Lot 37 ), in Schweppes yellow with a myriad Schweppes logos chopped up to boot, a delight for Gascoigne aficionados, sold for just one bid under the half million at $480,000 hammer.

Russell Drysdale’s Head of a Boy (1949) (Lot 38 ), will no doubt have left a few underbidders in its tracks. Size also seemed no barrier to price paid with this quite modest but very charming work, 40.5 x 30.2 cm, selling for a cool half million dollars hammer on estimates of $300,000-400,000.

The bidding war of the night perhaps should be awarded to Mr Streeton, or rather the bidders who sought to secure Cremorne (1926) (Lot 40 ). Once again, the guide price of $180,000-220,000 was left for dust as bidders pursued this painting as if it was the only painting they ever wanted.

This painting cramming in so much valuable real estate at Cremorne Point appears to personify the relationship between the value of property and the value of art in the current climate. Surely then a painting with so much valuable real estate must be worth more than one of purely bushland, mustn’t it? It ended up selling for $450,000 hammer.

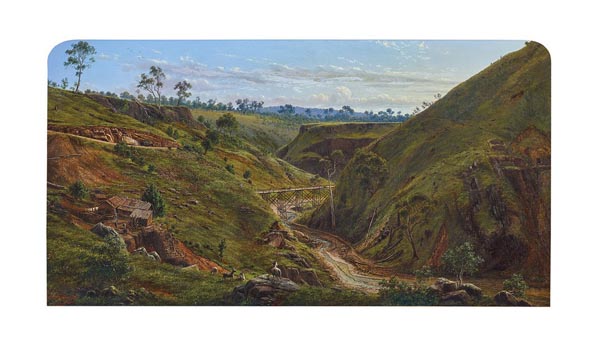

An epic landscape and one of von Guerard’s most important works Breakneck Gorge, Hepburn Springs 1864 (Lot 41 ) documents Australia’s gold rush in minute detail and has been held in the same family for five generations, now offered for sale for the first time in over 150 years. Estimated at $1 – 1.2 million, the painting didn’t disappoint, selling for $1.6 million hammer, or the second highest auction price for a von Guerard, after A View of Geelong sold for $1.7 million hammer over 20 years ago in 1996.

Coincidentally, the other large von Guerard, View of the Granite Rocks at Cape Woolamai, 1872 (Lot 46 ) had also not been offered in over 140 years after languishing in Mexico before its repatriation and now selling for $800,000 hammer.

Some other rather stunning results went to Neil Douglas’ Garden, 1958 (Lot 53 ) by John Perceval; its estimate of $22,000-28,000 was eclipsed by the $60,000 hammer achieved. J.S. Watkins’ Goldfish 1919 (Lot 75 ), with expectations of $15,000-25,000, swam to $85,000 hammer, and Nora Heysen’s Interior (1935, dated 1938) (Lot 78 ) doubled the high estimate and sold for $120,000 hammer.

All five of Arthur Streeton’s paintings sold, including Corfe Castle (1909) (Lot 85 ), for a surprisingly modest $46,000 hammer. This English scene was purchased by an Englishman seated next to me, and appeared well chuffed with his purchase. A comparable and larger version of the same scene was donated to the National Gallery of Victoria in 1914 as part of the Felton Bequest.

The only loser of the evening appeared to be Norman Lindsay, as all four of his offerings failed to secure buyers on the night.