There has been no fundamental improvement to the Australian market since then. In fact, what looks like a steadying of turnover at approximately $100 million represents a decline in real terms. It’s common for commentators to compare auction data without adjusting figures to allow for inflation. But this renders comparisons meaningless. Although raw data for 2019 represents a slight gain in total revenue generated from the previous year - $111.84 million (YTD), compared with $107.15 million for 2018 – when considered in the context of the previous decade, there has been a decline in the market overall. The total value of sales in 2010 was $103.3 million, which when adjusted for inflation amounts to approximately $125 million in 2019 dollars – over $13 million more than the total for this year.

This isn’t to say that the Australian art auction market doesn’t have its strengths. 2019 showed that the feeding frenzy of the boom has matured into a sophisticated marketplace where carefully curated offerings are rewarded. We have a boutique auction trade, where engaged buyers are keenly interested in the works that appear on the market. New and exciting offerings attract enthusiastic bidding, but lazy scholarship and merry-go-rounding of the same artworks are punished.

This is reflected in the combined clearance rates for the five biggest auction houses, Sotheby’s Australia, Deutscher + Hackett, Menzies, Leonard Joel, and Bonhams, which attained 94% clearance by value, and a respectable 72% by lot number. The figures for Sotheby’s, Deutscher + Hackett, and Menzies were very healthy overall; Menzies cleared a total of $20.11 million for the year, with a clearance rate of 85% by value and 81% by lot, and D+H turned over $21.34 million with a clearance rate of 107% by value, and 82% by lot. Sotheby’s total sales were $39.65 million, but the clearance rate by lot number was significantly lower than its competitors with 92% by value and 68% by lot. This was attributable to the low figures for Sotheby’s three Arts & Design auctions, which cleared just 68% by value, and 56% by lot. This, alone, would be reason enough for the discontinuation of these sales from the 2020 line-up at the newly minted Smith & Singer.

With all the talk about righting gender equity in the art market, there was no shortage of evidence to point at a reassessment of outstanding works of art by important female Australian artists. Melbourne artist, Mirka Mora, was celebrated in Leonard Joel’s auction of her studio contents in March, while Davidson’s Auctions staged an all-women affair, with David Angeloro’s collection of Australian women artists achieving new records for many previously undervalued artists including Christine Asquith Baker, Ina Gregory, Constance L. Jenkins, and Lilla Reid.

In 2019, the Grosvenor School artists reached the stratosphere. At Menzies’ Spring sale, Ethel Spowers’ Resting Models was knocked down at $33,136 (incl BP) (est: $5,000-8,000), while at Deutscher + Hackett’s November sale, Dorrit Black’s Still Life, Dahlias sold for $67,100 (incl. BP)(est: $25,000-35,000). A taste for Modernism fed into the market for the ever-popular Margaret Preston; at Bonhams, the fresh-to-the-market Bunch of Flowers doubled its low estimate, while Indoor Still Life at Deutscher + Hackett achieved $268,400 (incl. BP) (est: $150,000-200,000). Grace Cossington Smith, Margaret Olley, Clarice Beckett and Joy Hester were all represented by significant sales across the major auction houses.

Discerning buyers also snapped up the scarce Bronwyn Oliver works to come on the market, led by the record sale of Shell, at Menzies’ June auction for $441,818 (incl BP), a work from the auction house’s proprietor’s own collection. A major Inge King sculpture, also from Mr. Menzies’ collection, sold for the record price of $184,091 (incl. BP).

But the female artist attracting the most buzz in 2019 was Cressida Campbell. Her watercolours overlayed on printed woodcuts consistently exceeded high estimates, reaching a new record price of $292,800 (incl. BP) at Sotheby’s August auction. Deutscher + Hackett’s auctioneer Scott Livesey described Campbell’s work as the “talk of the town”. With über-dealer Philip Bacon in her corner, we can expect to see demand for Campbell’s work to remain feverish.

Discerning buyers responded to artworks that were new to the market. Although there were some disappointing results for major works offered from Charles Blackman’s Alice series during the year, at Menzies’ March auction, Hill Farmer, 1954, reached $245,454 (incl BP) (est: $120,000-160,000). At Menzies’ Spring sale, demand was also high for signature Tim Storrier pieces, and three works by Rick Amor, including the important painting, The Waiter, which sold for a hammer price just shy of the artist’s record price. Deutscher + Hackett tapped into enthusiasm for Ian Fairweather’s work, selling Barbecue, 1963 for a new record price of $1,708,000 (incl BP).

At Deutscher + Hackett, John Brack’s Yellow Legs – another fresh work on the auction block - featured on the catalogue cover, and sold for $1,195,600 (incl BP). Bonhams’ sale of Sir Warwick and Lady Fairfax’s collection featured a record price for a major work by Ray Crooke, doubling the estimate at $439,200 (incl BP), and more than doubling the artist’s previous high price. Sotheby’s first sale of the year featured unfamiliar works by Ian Fairweather, Russell Drysdale, Arthur Boyd, and Charles Blackman, and in August, Frederick McCubbin’s An Old Politician, 1879, which had been held by the same family since the 1880s, sold for $585,600 (incl BP), five times the estimate.

The same pattern can be seen in the market for traditional art. When fine, fresh examples appeared on the market, buyers responded. One of the highlights of Menzies’ March auction was a collection of impeccably provenanced works by Colonial artist, Thomas Balcombe – one important work, Gundaroo Natives, doubled its low estimates. At Deutscher + Hackett, fine works by Penleigh Boyd, Charles Piguenit, and Conrad Martens sold well, as did a key work by Modernist, Roland Wakelin.

An artist whose work was in high demand throughout the year was William Dobell, a rush set off by the notable sale of Woman in Restaurant at Sotheby’s first sale of the year. The painting, which has been on long-term loan to the AGNSW, sold for $939,400 (incl BP) (est: $80,000-120,000). Study for Portrait of an Artist (Joshua Smith) then sold at Bonhams for $915,000 (incl BP), and Dead Landlord was knocked down for $1,220,000 (incl BP) at Sotheby’s.

International art also fared well in the local market. Echoing trends in Australia where the Hans and Nora Heysen retrospective at the NGV ignited interest in both artists, a Royal Academy exhibition by Antony Gormley had a positive effect on his prices locally; two sculptures at Sotheby’s auction of the Rae Rothfield collection doubled their estimates of $80,000-120,000, and a new record price of $549,000 (incl BP) was set for Small Yield, 2015, at Deutscher + Hackett’s November sale. Menzies cornered the market in international prints, with significant sales of work by Andy Warhol, Banksy and Damien Hirst.

Results for some international works showed there are still surprises to be had in the art auction marketplace; Bonhams, which has been focusing on the market for Asian art, put two works by Chinese artists, Huang Zhou (attributed) and Yang Zhiguang, up for auction, each with a high estimate of $800. Both works blasted through this upper range, selling for $39,040 (incl BP) and $26,840 (incl BP) respectively. At Leonard Joel, a Dutch School painting, The Grinder, sold for $30,000 (HP) against a high estimate of $2,500, while at McKenzies, two early 19th century paintings of Naples sold for $56,640 and $47,200 (incl BP) against an estimate of $8,000-14,000.

Authenticity scandals have made the news in recent years, and 2019 was no different. Brett Whiteley’s painting, Bather and Garden, which had a provenance that featured dealers John Playfoot and Rob Gould, was excluded from Kathie Sutherland’s catalogue raisonné of the artist’s work. In what was an unfortunate string of bad luck for Gould, he was sued by a Sydney art collector when a Howard Arkley painting Gould had sold, Well Suited Brick Veneer, was refused copyright permission by Arkley’s estate. In the wake of this, two more problematic Arkley paintings turned up.

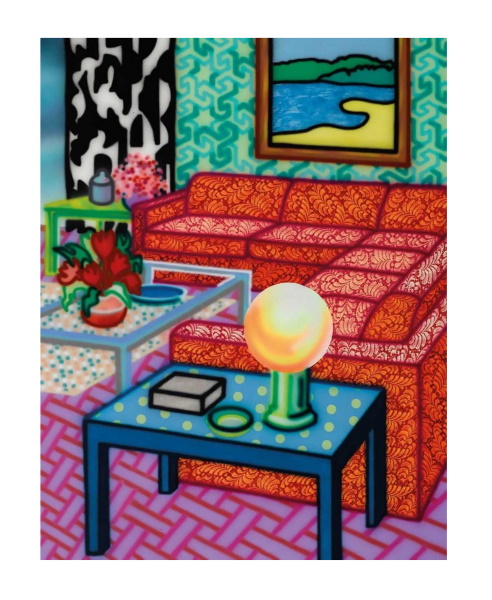

In a stroke of remarkable good fortune for Arkley’s collectors, despite the publicity around the problematic works, his market rallied. His record price was broken three times in 2019, one at each of the three major auction houses, the pinnacle being reached at Menzies’ June auction where Deluxe Setting, 1992, sold for $1,524,090 (incl BP). Even the now-familiar Zappo (Cityscape Mural), 1984, which changed hands four times at Menzies-related auction houses between 2007 and 2012 for prices ranging from $24,000-36,000, did very nicely on this outing, selling for $50,000 (HP).

The year ended on a much-needed positive note for the market in Aboriginal art. During the peak of the market, the sale of art by Indigenous Australian artists generated approximately 15% of the total annual auction turnover. Since 2010, that figure has dropped back to an average of 8%. In 2019, actor and art collector, Steve Martin, and the world’s most influential art dealer, Larry Gagosian, collaborated on an exhibition of Aboriginal art from Martin’s own collection at Gagosian’s Manhattan gallery. Elsewhere, a major Emily Kngwarreye painting, Yam Dreaming, 1996, was shown at Art Basel by New York gallery, Salon 94, along with works by Warlimpirrnga Tjapaltjarri and Yukulji Napangati. In the wake of this international interest in the art of the First Australians, Adrian Newstead’s Cooee Marketplace auction brought in a total of $1.072 million (incl BP), with a respectable 77% clearance by lot number, and 97% by value. Sotheby’s much publicised New York auction generated A$4.050 million (incl BP) with clearances of 88% by lot and 118% by value.

It’s worth closing the year with a moment to think about the art identities who left us in 2019: Graham Joel; Tim Hogan; Edmund Capon; Martyn Cook; Lauraine Diggins; Peter Webb; and Keith James. Vale.