Some artists have welcomed this proposed new charge as a way of leveling the playing field with authors and composers, especially in periods of low primary market sales such as now. Others have lamented the lack of equity in the way most of the levy will be shared by already high-earning artists and their estates.

There is however general consensus that some form of resale levy is necessary to address issues in the Australian art market that have been highlighted by the media in the past year. Below is a discussion of some of the issues that will be relevant once the levy becomes law.

Background to the Royalty Resale Levy

The levy is an outcome of the 2002 Myer Report which examined funding for the visual arts, and was aimed particularly at addressing issues of inequity in the Aboriginal art market. Most famously it cited the case of a Johnny Warangkula Tjupurrula painting bought from the artist for $150 and subsequently sold at auction for $260,000. Myer recommended the introduction of a national resale royalty scheme to address such iniquitous situations and to provide a livelihood to practicing artists.

In 2008 the Resale Royalty Right for Visual Artists Bill was drafted in support of the Myer recommendation. It sought to apply a royalty of 5% on the second resale of artworks (after the commencement date of the legislation) equal to or greater than $1,000 produced by Australian artists for a period of up to 70 years after their death.

A Standing Committee was formed early this year to take submissions from interested parties in relation to the operation of the levy. Minister for the Environment, Heritage and the Arts Peter Garrett delivered its findings in late May, with the only changes contemplated being procedural ones such as defining artworks under the scheme and determining the commencement date.

What is meant by the second resale of artwork?

The resale royalty will apply to the second resale of an artwork after the commencement date. This would appear to mean the second time an artwork is sold after being purchased from an art gallery. But beware. Aboriginal artworks may be considered to have been resold the first time when bought from an art gallery as typically these works are purchased initially from a community art centre, which then pays the artist. This system has been developed specifically to ensure integrity in the Aboriginal art market but it also creates an argument that the first offering of such artworks at auction would be the second time sold and trigger the levy.

Further, many artworks sold by galleries are on behalf of artists not registered for GST. The system developed to handle this practice calls for art galleries to issue recipient-created tax invoices to artists once works are sold to their clients. ATO guidelines in relation to these invoices describe them unambiguously as purchases. There will be an argument (supported by lay people I have asked) that as a recipient-created tax invoice is evidence of a purchase of artwork, the resale royalty will apply to the next sale of that artwork.

Will it achieve its aim to support the majority of artists?

Similar resale royalty schemes overseas have benefited in the main a handful of successful artists and their estates. It is estimated that 75% of all resale royalties in France is paid to the estates of Matisse, Picasso and five other artists and their families. A recent study in the United Kingdom found that 98% of artists received no payment at all and 47% of the money collected went to 20 high-selling artists. (The UK scheme has a higher threshold than the proposed Australian levy).

At the lower end of the market one can envisage a great incentive for dealers and sellers to transact at $999 or less to avoid the cost and paperwork of an additional 5% for transgressing the levy threshold. As the threshold includes GST but not buyer’s premium one can also envisage auction houses increasing this charge when the levy is introduced.

Effects of the Levy on art collectors

Many collectors, like it or not, are focused on the investment side. Galleries devoted to exhibiting and promoting the work of contemporary Australian art will find themselves competing with classes of artworks unaffected by the levy such as early nineteenth-century painting, decorative arts and works by certain international artists.

As the levy applies for a period of 70 years after the artist’s death, vendors may have incentive to withdraw paintings if this threshold period is imminent. For example, as Arthur Streeton died in 1943 there is a possibility of resale royalties being collected by his estate until 2013, even on works of art produced in the nineteenth century. Resale royalties will be liable until 2045 to the estate of JR Jackson and until 2058 for the estate of Lloyd Rees. Submissions made to the Standing Committee to reduce the collection period to 50 years were not considered.

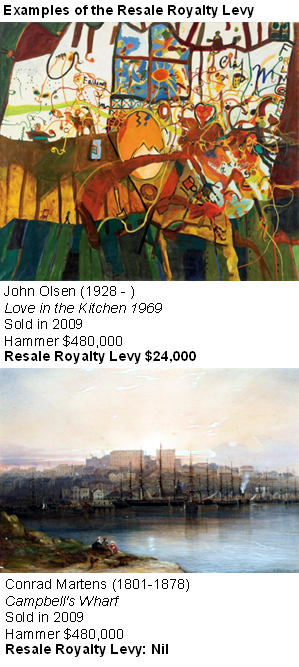

There is no cap on the amount of the levy. In the United Kingdom a maximum threshold of 12,500 euro applies for any single artwork each time it is sold. Sotheby’s appealed without success to the Federal Government to introduce a similar cap to prevent high-value artworks being sold offshore. At the current exchange rate of the Australian dollar to the euro the maximum threshold on the levy for similar artworks sold in Europe would be about $22,000.

Put another way, a strong incentive will exist for Australian artworks valued at $440,000 or more to be traded offshore once the levy is introduced. This will have a direct impact on the activities of the major auction houses and private dealers who rely on commissions from the big-ticket Australian artists – John Brack, Charles Blackman, Sidney Nolan, Fred Williams, Brett Whiteley, Jeffrey Smart – to fund their operations.

A painting as an object is not that expensive to ship overseas, and may be well worth considering if there is enough monetary reason to do so. John Olsen’s “Love in the Kitchen” 1969, sold by Bonhams & Goodman in May this year for $576,000 would have attracted a resale royalty levy of $24,000 – this is already more than the equivalent European cap at the current exchange rate.

Liability to pay the levy borne equally by vendor and agent

The resale royalty levy will be administered by a “collecting society” which will act as a watchdog on the commercial resale of artists’ work and enforce the provisions of the legislation. Note that unlike the voluntary copyright collection arrangements, the resale royalty is a compulsory monopoly management right. The collecting society has yet to be appointed but it will be a company chosen by public tender once the legislation has been passed.

The liability to pay the levy is borne equally by the seller and by the art market professional transacting the sale. Auction houses will have no choice but to deduct the levy and pay the collecting society themselves rather than risk the vendor not doing so. It would also be strongly recommended that all enterprises in the sale of artworks adopt the practice of maintaining trust accounts immediately prior to the legislation being passed.

Final thoughts

There will be positive outcomes from the legislation. Galleries, art dealers and auction houses will have great incentive to operate more efficiently. A register of artworks will result from the records of resales that should assist the widely publicised problem of fakes and forgeries in the industry. Some artists will benefit by receiving supplements to their income similar to composers of music or authors of books.

The Myer Report recommended the resale levy along with greater government funding for the visual arts as its main policy outcomes. There will be a review of the levy within three to five years of its commencement date.

It is hoped that this review will also look at the balance between public and private investment in the arts, for without the right sort of incentives to private galleries, collectors and dealers to continue their patronage, Australia could end up with too much State influence over the arts creating barriers of entry to potential new participants.

There is no doubt there will be all sorts of unintended outcomes from the resale royalty levy, however the die has been cast and all art enterprises should be aware the scheme is but a matter of weeks from being law.