A jubilant Menzies chairman and the owner of Menzies, Rodney Menzies, claimed after the sale that the $10.37 million total supported the company's claim to leadership of the art auction market in Australia.

This was equal to a clearance of 76% by value and 89% by volume.

Menzies said he was immensely satisfied with the result.

His jubilation appeared at some odds the a sale that had produced numerous lots sold below estimates.

The estimates often already represented big-mark downs on boom time prices.

But as a big vendor and buyer he enjoys a lot of benefits from the ownership of the operation such as effective remission of any vendors' fees to himself together alongside the buyers' premium.

Menzies may charge (Mr) Menzies these fees but they flow back into his own pocket.

The overseas works sold for around what he had recently paid for them in the US.

However, they appear to have secured the market leadership that is such an important factor in attracting other new business and is also a matter of great hubris.

The total transparency in their presentation including cataloguing notation of the prices paid was widely applauded in a local market almost exclusively comprised of local art and focussed on a small group of well established artists.

The three works looked fresh and vigorous in a sale otherwise dominated by big works.

Several of these works were just short of potboilers and by these artists desirable mostly for their signature and scale, only too worthy, it could be argued, of the much derided Mcmansions that have been going up from the waterfronts to the outer city suburbs.

It was an amusing coincidence that the leading colour of the three big ticket Australian paintings was orange, which is made by mixing yellow and red (the McDonalds' colours) together.

Previous attempts to sell overseas art in Australia have been met with great suspicion by collectors wondering why it was being offered so far from the obvious centres of distribution and art marketing.

Big efforts were made with minor works by modern masters at Geoff K Gray's in the 1960s and publisher Len Voss Smith's bids to sell works by minor French Impressionist masters at the fledgling Christie's Australia operation with which he was associated in the early 1970s.

Melbourne dealer Georges Mora tried with similarly unambitious work by greater masters at Melbourne's Tolarno Galleries in the 1980s and Gerald Norman, whose estate will be sold this weekend in regional Britain, through a gallery in Toorak over a similar period.

They added little to the stock of great international art Down Under. The recent rise in the dollar had surprisingly attracted little other known direct buying overseas although some dealers are beginning to test the water with emerging/contemporary British art.

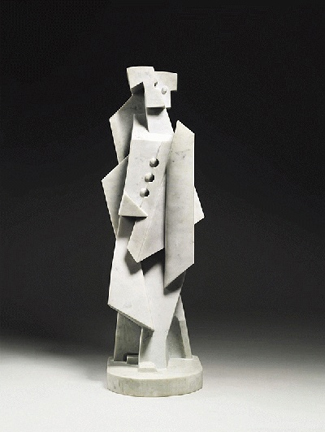

Menzies' inclusion of three sculptors by modern masters Jacques Lipchitz, Aristede Maillol and Jean Arp in the sale of Important Australian and International Fine Painting and Sculpture on June 23 was in a different league.

By presenting the works with such transparency Menzies showed he was prepared to be left with them if they did not sell.

The Lipchitz Arlequin a la Clarinette, (Lot 45) a 1.1 metre marble sculpture from 1971, sold to a telephone bidder for $700,000 ($857,000 IBP), that is the bottom of estimates ranging up to $900,000.

With the sliding scale buyers premium of 20-25 per cent and the cost of transport (higher for sculpture) Menzies was not too much out of pocket on the $US842,500 he paid for it in May this year.

The work had received some favourable exposure in the Jewish News so the work may have been well targeted.

Maillol's Baigneuse Debout se Coiffant, le Coude Leve, (Lot 34) a 20 cm tall bronze from an edition of six, sold for $90,000 ($112,500 IBP) against estimates of $80,000 to $100,000. Menzies had paid $86,500 for it also in New York in May. Again the buyers premium, which is not included in estimates, came to the rescue.

Torse Fruit, (Lot 44) a 75cm tall bronze by Arp estimated at $450,000 to $550,000 sold for $460,000 ($564,000) to a familiar Menzies private buyer in the room.

Two big orange Australian works entirely fresh to the current market fell short of their estimates but found buyers at solid prices.

Fred Williams Werribee Gorge II of 1978 (Lot 43) sold for $420,000 ($515,400 IBP) against estimates of $400,000 to $500,000 and while Brett Whiteley's The Paddock - Late Afternoon (Lot 46) sold for $1.3 million ($1.58 million) against $1.4 million to $1.8 million estimates.

The Williams went to a longstanding Menzies Auctions supporter Richard Blair, and the Whiteley to the telephone. Another Whiteley, The Orange Table, (lot 48) made $725,000 ($887,500) against $800,000 to $1 million estimates.

The price of The Orange Table sold was remarkable, as it had made only $462,500 in 2002 and $310,500 in 2000.

More obvious weakness in the Whiteley market, however, was visible in the top bid for $320,000 ($393,400 IBP) successfully offered by Sydney private dealer Michael Nagy for Whiteley's mixed media on board Vanessa (Lot 50)(estimates $300,000 to $380,000.)

This compared with $420,000 hammer of $504,000 with premium) in 2008.

Works by other eminent Australian masters such as Arthur Boyd Russell Drysdale, Ian Fairweather, Rosalie Gascoigne and John Brack and even the perennial favourite Jeffrey Smart sold for less than their lower estimates or just scraped them.

Before an adequately crowded room, Martin Farrah set a confident tone from the rostrum in his first sale as managing director of Menzies Auctions. Apart from thunderous applause at the end and a chirping cricket that led to considerable distraction when one of the lots was offered, the sale ran quietly, smoothly and mostly uneventfully. Only the the passionate bidding of the mid noughties remained elusive and there was comfortable surfeit of empty seats.

The traditionals were very thinly represented with little trend setting. The failure at best bid of $42,000 of Ethel Carrick Fox's brightly coloured Choosing a Bouquet (Lot 30) to sell (estimates $50,000 to $70,000) may mean that buyers are beginning to recognise the difference between the stature of the work produced by her compared to her husband Emanuel.

This is thanks to an exhibition of the two together at the Queensland Art Gallery.