The former cinema appeared to have too much space and glamour for a collectibles operation based largely on Internet auctions.

Stamp auctions, in which Charles Leski had its basis, often attract no more than a handful of people.

Art auctions tend to rely more on a crowd and theatre.

Now there will be room for the two of them with the merger should also greatly reducing costs while maintaining the glamour long associated with the building and very much a part of the industry.

The move frees up the South Yarra gallery building in which Mossgreen is currently based and which was leased.

Sumner told AASD that the company's plans for development of the building were very exciting and would make it a first class venue for both fine art and collectibles auctions.

He remembers Dame Elisabeth Murdoch having to enter the old building via a goods lift. The renovated building will do better than this, he promised..

Holding the occasional art sale, Leski has shown interest in participating in the fine art business but it has been dominated by bigger more established names like Sotheby's and Bonhams.

The merged operation will embrace this ambition at a time it could use fresh blood and financial backing.

The board will include Melbourne businessman Jack Gringlas who, “identified this new and exciting opportunity to invest in and lend his considerable managerial and entrepreneurial experience,” Mr Sumner, the managing director of Mossgreen, said.

As has been shown by Melbourne auctioneer Leonard Joel's sortie into the area, the collectibles business meanwhile has not been flagging without the mercurial twists of the art market.

Sumner said he had never underestimated the reliability and solidity of this side of the auction business.

Sumner is inputting a boutique art and antiques operation which appears to have tapped neatly into a niche market thanks to the considerable energy he has been seen to put into it.

This involves the sale of smaller private art collections of which numerous were put together during the 90s and early noughties but which are now becoming available to the market.

The merged entity will be branded Mossgreen and will initially incorporate the Leski name for collector’s categories.

The joint venturers claim the combined sales of the companies of approximately $20 million make it Australia's third largest auction house by turnover in Australia in the art, memorabilia, collectibles and philately markets.

A new board of directors will comprise Jack Gringlas as non-executive chairman, Charles Leski as managing director of Mossgreen Collectors Auctions and Paul Sumner as managing director of Single-Owner and Asian Art Auctions and Mossgreen Gallery.

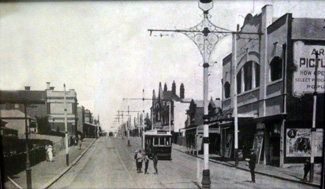

“The former home for Sotheby’s will be subject to extensive refurbishment, due for completion in September, “ Mr Sumner said.

“It will also house Mossgreen Gallery and Mossgreen Tea Rooms.”

Charles Leski said the merger would not only be “significant in financial terms” but in its ability to expand the markets for which both Leski Auctions and Mossgreen are major players.

“Leski Auctions is one of the largest auctioneers of cricket memorabilia in the world,” he said.

“We have also established a name as the auctioneer behind rare and iconic collectibles including Captain Cook’s pistol, a handwritten notebook of the tonics fed to legendary racehorse Phar Lap, and Dan Kelly’s pistol from the siege of Glenrowan.

“The merger will present us with opportunities to achieve even greater market penetration, which will instil confidence in buyers and sellers globally. We regard this as one of the most important outcomes from this initiative.”

Sumner, who established Mossgreen in 2004 as a single -owner auction specialist and gallery, was previously managing director of Sotheby’s in Australia.

Sumner said that by 2012, Mossgreen was the market leader in Fine and Decorative Arts and Antiques and also finished the year with the highest total in sales for Indigenous art.

“On a personal level, I am looking forward to returning to the building in which I had my early business success while managing Sotheby’s operations in Australia,” he said

Gringlas who appears to be a key figure in the merger, was named an Ernst & Young Entrepreneur of the Year in 2008.

He is the former owner and managing director of CMG Engineering Group, which operated in eight countries. It was the market leader in Australia in the manufacture and sale of electric motors and related products.

In 2010, Gringlas sold CMG to Regal Beloit Corporation of the USA.