Less than a month after the stunning announcement that Tim Goodman’s First East Auction Holdings had acquired the licence to operate Sotheby’s Australia and in effect merge its operations with Bonham’s & Goodman, it is evident that one of the big winners from these machinations will be Leonard Joel.

The air of optimism was palpable at Joel's rooms at 333 Malvern Road as Tim Goodman and John Albrecht celebrated the milestone with flowing champagne and canapes (Goodman joking that the papers do say he enjoys his food and his drink) before presenting a birthday cake, cut by Graham Joel to the rousing cheers of “for he’s a jolly good fellow.”

In 1919 Graham’s father Leonard founded the eponymous business in the cramped confines of its first address in Little Collins Street, central Melbourne. During this first period of its life, which coincided with the interwar years, the focus of the Joel business expanded to include sales of fine art, decorative arts and furniture, books and manuscripts as well as jewellery and watches. That is, the nature of the business came to resemble its modern counterpart in a relatively short timeframe.

Central to this growth was the ability of Leonard Joel to efficiently and fairly handle the disbursal of large estates, some of which like the Lansell sale in 1934 attracted intense media interest. This has been a feature of the Joel business over its history.

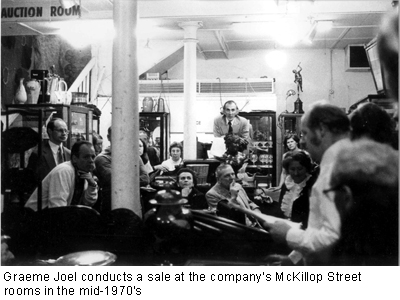

Intergenerational change occurred in 1958 with the passing of Leonard. Concurrently the auction rooms moved to McKillop Street in the Melbourne CBD (a stone’s throw from the Kozminsky business John Albrecht’s family had acquired). Leonard’s son, Graham had joined him in the business in 1944, aged just 16 years, and was thus well-equipped to continue the family tradition. In the end Graham Joel managed the business for almost half a century before his son Warren assumed the reins.

Graham Joel has always said the firm’s success has been based on ‘absolute integrity coupled with a deep knowledge of the products and goods valued and auctioned and complete discretion with its clientele’. What is also apparent, particularly last night with the presence of art market professionals such as James Makin and Scott Livesey to name but a few, is the way this knowledge has been passed down the generations.

Throughout the history of Leonard Joel, key individuals have played prominent roles in the evolution of its various departments. Thomas Dwyer started the firm’s involvement in fine arts and books through the period 1920-1959. His son Paul Dwyer then headed the fine art department during a period of extraordinary growth in the appreciation and value of Australian art. One notable milestone was the sale of the first Australian painting sold at auction for over one million dollars in the late 1980s. Paul’s son Jon continued this family tradition before joining Christie’s in the late 1990s.

John Albrecht first joined Leonard Joel in 1987 and became auctioneer and director of the jewellery department, spearheading its expansion into national markets. He rejoined the Joels business in 2006 with the creation of Joel Fine Art, a specialised division for the premium end of the fine art market, distinguished by its ability to transact large private treaty sales.

JFA became the first casualty of an overcrowded fine art market last year when the Joel family decided to close its operations and sell its traditional LJ business to Tim Goodman’s group. In June this year John was made chief executive and took up an offer to become a minority shareholder in Leonard Joel.

His timing has been immaculate. As Tim Goodman was reported in The Australian Financial Review yesterday “Leonard Joel is positioned beautifully to accept referral business from Sotheby’s, and from any other auction house for that matter.”

SIGNIFICANT JOEL SALES

Viewing the volumes of auction catalogues accrued over a 90 year period is like opening a time capsule, shedding light on the evolving tastes and desires of Australian society.

The first major sale conducted by Leonard Joel was the George and Edith Lansell sale in 1934, which auctioned the fine and decorative arts accumulated by an archetypal Victorian family whose wealth came from the mid-nineteenth century goldfields and whose estate Fortuna, could have been used as a set in Orson Welles Citizen Kane.

According to the auction catalogue: “With a discriminating taste, both the late Mr George Lansell and Mrs Edith Lansell took many years and spared no expense in accumulating from far and wide this ‘grand’ gallery of interest to connoisseurs and Trustees of Art Galleries.” In viewing this truly amazing treasure chest of art and antiques one is made aware of the dominant tastes of the society classes of the late nineteenth century which continued to prevail before the Second World War.

Modern art is nowhere to be found. The closest the Lansells came to collecting a ‘modern’ was William Merritt Chase (also the only American represented) but this was for one of his early Munich old master paintings. French Impressionists? Not represented at all. Australian painting? Scheltema is the only flag-bearer here in any depth, contrary to our contemporary view that most early Australian collections would contain scatterings of Heidelberg School or even early colonial artists like Glover or van Geurard.

What is striking is how similar the Lansell’s tastes were to the trustees of the National Gallery of Victoria in administering the Felton Bequest during the same period. In the first 27 years of the Bequest (commenced in 1904) the trustees spent 314,590 pounds acquiring artworks, of which only 29,490 pounds were allocated to Australian artists.

What is also apparent in viewing the Lansell sale from a distance of 75 years is their admiration for Academic painting, the Old Masters and ancient antiquities. Represented in their collection were paintings by Alvarez (Spain), Constable (England) and Jan van Kessel (Holland); Roman ivories, Chinese vases and Royal Doulton porcelain.

The next significant sale in 1952 was the first of two landmark sales Leonard Joel would conduct for the estates of famous Australian artists - the estate of E Philips Fox and his wife Ethel Carrick Fox. This catalogue has the look and feel of a Sunday psalms at your local church, a single sheet catalogue folded to give 4 sides listing an incredible collection of 50 paintings, 27 works on paper as well as a number of lithographs. There are no measurements, dates or illustrations; however this sale presented the opportunity for devotees of these important artists to purchase the brushes, paints and easels from their studio.

The second major artist estate sale, Hans Heysen 1970, showed just how far the appreciation of Australian art had come since Lansell. In the foreword to the catalogue trustee Sir Edward Hayward noted “Without doubt it will be one of the major art sales of an Australian artist ever held in this country.” He was not wrong. Apart from the works of Heysen and his family, the sale included key paintings by William Ashton, Norman Lindsay, John Glover, Rupert Bunny, Philips Fox, Louis Buvelot, Frederick McCubbin, JJ Hilder and Eugene van Geurard.

A few years before the Heysen sale, Leonard Joel conducted two landmark sales within a year of each other that materially shifted the value of Australian art. The first was the Charles Ruwolt sale in 1966, which was like Lansell founded on an archtypal Australian business success story, this time in the pastoral industry of the twentieth century.

Ruwolt’s collection was housed at his station property Yarramundee in regional New South Wales. He had numerous works by Arthur Streeton but also David Davies, Elioth Gruner, and many of the artists mentioned above in the Heysen sale.

In 1967, the collection of gallerist George Page Cooper was put to market. An eclectic and widespread array of more contemporary Australian art, the sale consisted of 404 lots and there were 91 artist biographies to assist those not familiar with some of the newer names. With hindsight one could have bought John Brack’s drawing Country-men (lot 317) for $200 at this sale. Or one could have bought Adrian Feint’s oil Pink Magnolias (lot 308) for $140. The former purchase would by now be showing an increase in value of between 50 and 200 times, the latter would also have increased in value, but nowhere near as materially.

One of the more memorable Leonard Joel sales was the sale of the Claire MacKinnon jewellery collection in 1982. Mrs MacKinnon had started her collection in the 1920s when she was a silent movie star in Hollywood. When she married Scobie MacKinnon and returned to Australia her American assets were sold and the proceeds invested to expand her jewellery collection. Over time the collection continued to grow with many pieces designed by renowned jewellers. The sale of the collection enabled the historic Mooramong Homestead at Beauford in the Western District to be preserved.

Leonard Joel played an important role in the breathtaking growth of the Australian art market in the 1980s and it then played a role in the contraction of the market at the beginning of the next decade with the sale of some of the collections of the more notorious entrepreneurs. One such significant sale was Christopher Skase’s Qintex collection. In fact if you picked up a Leonard Joel catalogue at random from say 1991 you would find “Under Instructions from and the Properties of” such companies as Equity Trustees, Perpetual Trustees, Insolvency and Trustee Service Australia, State Trustees and even the Bailiff’s Office.

In 1998 with the Australian art and antiquities market in recovery, Leonard Joel transacted the Rogowski Collection, which is probably the only catalogue I have viewed printed in hardcover. Edward and Danuta Rogowski came to Australia as part of the post World War II European migration and eventually became major players in the arts and antiquities through their Moorabbin Antiques business. Their world view was a juxtaposition of Old World taste and refinement with Australian pride.

The last major single vendor sale conducted by Leonard Joel occurred in 2007 when the Marvin Hurnall Australiana Collection of approximately 1,000 items was sold for close to a million dollars. The sale became a benchmark to the valuation of Australiana, particularly with regard to ceramic, and its catalogues sought-after in their own right.

The challenge for Leonard Joel in its new reincarnation is to continue this proud tradition. The most successful single vendor sale this year, the estate of the late South Yarra resident Marjorie Kingston, was secured by E.J.Ainger. As the Australian Financial Review commented, once upon a time that sale would have automatically gone to Leonard Joel.

With the 90 year celebration there is certainly an air of optimism that Leonard Joel can recover its standing, particularly with its new ties to Sotheby’s Australia and under the stewardship of John Albrecht.