The first lot was a case in point: a modestly sized and very pretty in pink Arthur Boyd Evening, Shoalhaven River, 1976 (Lot 1 ) with a slender crane in the foreground, reminiscent of the artist’s oil on copper paintings from the period, was estimated at $25,000-30,000. Bidding was swift and from multiple bidders, leaving several collectors disappointed when it sold for the very substantial hammer price of $58,000.

Richly textured forest scenes from the 1960s are some of John Perceval’s most dynamic paintings. These semi-abstract impasto compositions still seem undervalued in the current market, but buyers were ready to embrace and see more value as Flooded Creek, 1960 (Lot 4 ) surged to a $95,000 hammer, considerably above its $55,000-75,000 expectations.

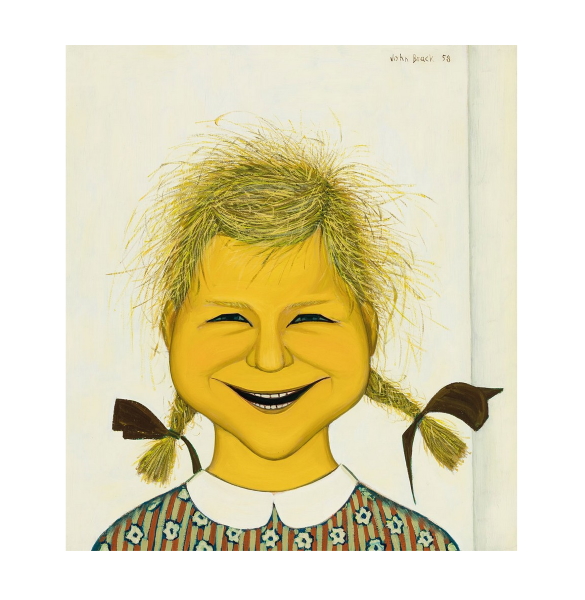

The much vaunted cover lot by John Brack, Laughing Child, 1958 (Lot 6 ) had not been seen since it was acquired by Clara Black from Australian Galleries in 1958. This “long lost” painting of the artist’s daughter Charlotte, with her big smile and straw-blonde hair tied in pigtails, caught the eye of several collectors, finally selling to Gary Singer’s phone bidder for $750,000 hammer, almost doubling its low estimate of $400,000.

There were a couple of commercially difficult Charles Blackmans; Swings, 1952 (Lot 7 ) and Double Image III, 1961 (Lot 9 ) both of which failed to find buyers on the night.

However, Joel Elenberg’s rare and typically sublime bronze sculpture Mask C, 1980 (Lot 11 ) encountered no difficulties. Estimated at $120,000-160,000, it sold very successfully for $180,000 hammer.

After some record breaking times for major paintings by Howard Arkley, and perhaps thus raising expectations ever higher, Stucco House, 1988 (Lot 12 ), was another test for the Arkley market. Achieving the second highest price of the evening, it sold right on the low estimate of $700,000.

A wonderful study with great perspective by Jeffrey Smart gave his collectors a chance to focus their minds. Estimated at a not ureasonable $100,000-150,000, Study for Bondi Penthouse, 2002 (Lot 13 ), was bought by Brett Ballard’s phone bidder for $160,000 hammer.

Brett Whiteley’s The Owl, 1983 (Lot 19 ) came with hopes of $30,000-40,000, and sold for a whopping $60,000 hammer to one wise collector, perhaps pre-empting thoughts that the Brett Whiteley catalogue raisonné due to be published this year will lift prices for the artist’s work.

Two delightful examples of Ethel Carrick’s early and prized work on offer were both competitively bid. On the Sands, 1910 (Lot 22 ), an atmospheric beach scene with red and white striped tents sold close to the top end of expectations for $190,000 hammer on estimates of $140,000-200,000. Meanwhile The Market, Caudebec, 1903 (Lot 27 ) fared even better: estimated at $140,000-180,000, this much larger painting sold for $225,000 hammer.

Two Frederick McCubbins were offered: the more impressionistic The Bathers, 1906 (Lot 23 ), did sell for $360,000 hammer, below its estimates of $400,000-600,000, while the more traditional landscape Winter at Nunawading, 1886 (Lot 26 ) failed to find interest.

Important paintings by esteemed British artist Sir George Clausen rarely appear at auction in Australia. A Village Boy, 1899 (Lot 24 ) comes with an extraordinary provenance. This ethereal portrait is dedicated to Lindsay Bernard Hall, the former director of the National Gallery of Victoria, so its current owners wanted to “almost give Australians the first right to refusal” (Geoffrey Smith as quoted in the Australian Financial Review, 17 June 2020). Estimated at $400,000-600,000, it sold on the low estimate to an Australian collector and will stay in Australia.

There is no sign that interest in paintings by Arthur Streeton – even late ones – is slowing down anytime soon. The quality as well as the demand for his work is neatly demonstrated in Bridge in New Norfolk, Tasmania (1938) (Lot 25 ). This luminous landscape had previously sold in 1972 at Leonard Joel for $4,800 and in 2003 with Sotheby’s for $77,500 hammer. Last night on estimates of $100,000-150,000, auctioneer Martin Gallon’s gavel finally came down at $240,000 hammer for a buyer in the room, after a prolonged battle of 6 phones and several room bidders.

The auction was held at the National Council of Jewish Women of Australia in Woollahra, and not in their usual location at the Intercontinental Hotel in Sydney. Prior seat booking was required due to the capacity limit of 50 attendees. In the end, attendance numbered in the 40s and they also proved to be active participants, making for a spirited live auction.

The auction totalled $6.621 million IBP, with 91% sold by value and 76% sold by numbers.